Unlock the secrets to boosting your rental property profits with these expert tips for maximizing returns and increasing cash flow.

Image courtesy of Karolina Grabowska via Pexels

Table of Contents

- Introduction to Rental Properties

- Understanding Your Rental Property

- Getting More Money from Rent

- Keeping Your Property Full

- Money Matters: Setting the Right Rent Price

- Good Relationships with Tenants

- Avoiding Empty Apartments

- Handling Problems Like a Pro

- Keeping Track of Money

- Smart Renting for the Future

- FAQs

Introduction to Rental Properties

Rental properties can be an excellent way to make money without a lot of effort. It’s like having a business where people give you money each month to live in a house or apartment you own. In this section, we will explore the concept of rental property ROI and share some valuable rental investment tips to help you make the most out of managing your rental property.

What is Rental Property ROI?

When we talk about rental property ROI, we’re talking about something called ‘Return on Investment.’ Imagine you saved up some money and used it to buy a house. You then rent out that house to someone who pays you rent every month. The money you make from this rental is your return on the investment you made when you bought the house. The higher the return, the more money you’re making from your rental property. It’s like turning your savings into something that makes you more money!

Starting with Rental Investment Tips

Now, let’s dive into some handy rental investment tips to help you increase your rental property ROI. You can make your rental property even more profitable by following some cool ideas that ensure you’re getting the most out of renting out a house or apartment. These tips can help you optimize your rental management and enhance the overall profitability of your rental property.

Understanding Your Rental Property

Being in charge of a rental property means you get to make decisions about a house or apartment people can live in. As the boss, you need to keep the place in good shape and make sure renters are happy. This includes fixing things when they break, making sure all the bills are paid on time, and being available to help when your renters need something.

Getting More Money from Rent

In this section, we will explore ways to increase the income you earn from renting out your property. By making strategic decisions and implementing smart upgrades, you can maximize your rental property’s profitability.

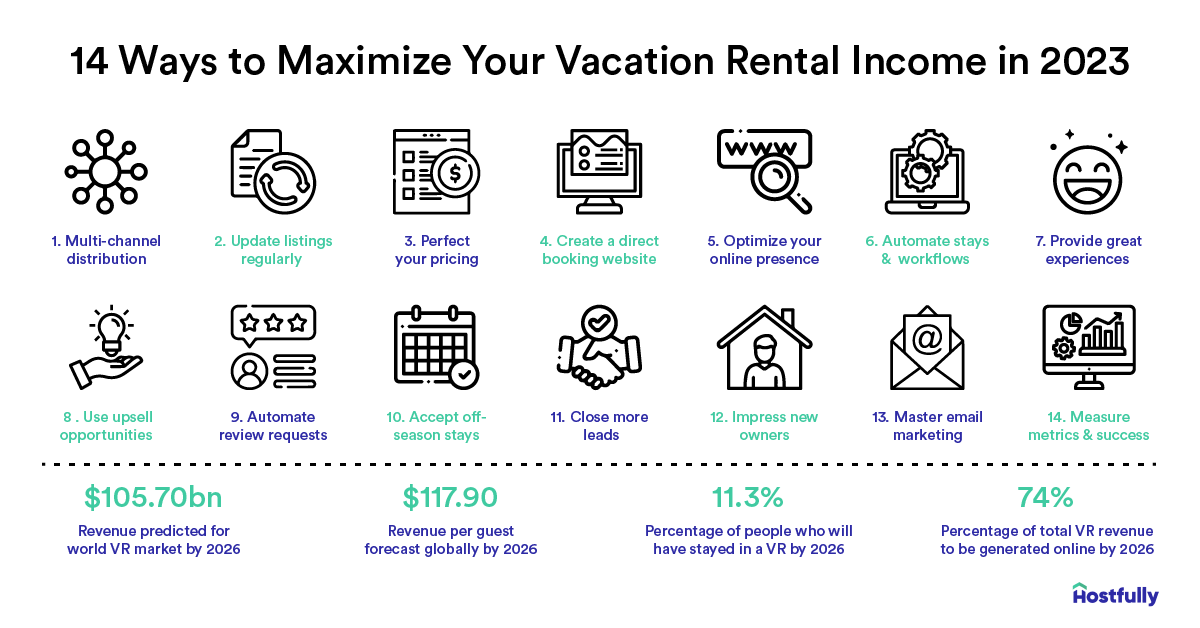

Image courtesy of www.hostfully.com via Google Images

Simple Upgrades that Add Value

One way to increase the amount of rent you can charge is by making simple upgrades to your property. These upgrades don’t have to break the bank but can significantly enhance the value of your rental. For example, adding a fresh coat of paint, updating kitchen appliances, or installing new fixtures can make your property more desirable to potential renters. By investing a little bit upfront, you can command a higher rent and attract quality tenants who are willing to pay more for a well-maintained and updated property.

By focusing on strategic upgrades that add value to your rental property, you can ensure that you are getting the most out of your investment. These small improvements can make a big difference in the rental income you generate, ultimately increasing the overall profitability of your rental property.

Remember, even simple upgrades can go a long way in maximizing the returns on your rental property. Investing in your property’s value is a smart way to attract higher-paying tenants and increase your rental income.

Keeping Your Property Full

In order to make the most money from your rental property, it’s important to ensure that someone is always renting it. Here are some tips on how to optimize your rental management to keep your property full and profitable.

How to Find Good Renters Fast

One of the key aspects of managing a rental property is finding reliable tenants quickly to avoid any vacancies. To do this, consider listing your property on reputable rental websites, asking for referrals from current tenants, and utilizing social media platforms to reach a wider audience. Conduct thorough background and credit checks to ensure that potential renters are responsible and will take good care of your property.

Money Matters: Setting the Right Rent Price

When it comes to owning a rental property, one of the most crucial decisions you’ll have to make is setting the right rent price. This amount needs to strike a balance between covering your costs and ensuring you make a profit. Let’s delve into how to figure out the perfect rent price that works for both you and your tenants.

Image courtesy of www.financestrategists.com via Google Images

Balancing Costs and Profits

Setting the rent price too high might scare off potential renters, leaving you with an empty property and no income. On the other hand, pricing it too low may not cover all of your expenses, ultimately eating into your profits. The key is finding that sweet spot where the rent is competitive for the area but still allows you to make a reasonable return on your investment.

Good Relationships with Tenants

Here we will discuss why being friendly with renters can help your business.

Communicating Clearly and Kindly

Communication is key when it comes to building good relationships with tenants. Listening to their concerns and addressing any issues in a timely manner shows that you care about their well-being and comfort in the rental property. Clear communication can prevent misunderstandings and help create a positive environment for both parties.

Avoiding Empty Apartments

We cover strategies to make sure someone is always living in your rental, so you always make money.

Image courtesy of myerscapitalhawaii.com via Google Images

Marketing Your Rental Property

When you have an empty apartment, you aren’t making any money. That’s why it’s essential to tell people about your rental property so they can move in and start paying rent. Here are some tips on how to market your rental effectively:

| Step | Description |

|---|---|

| 1 | Research high-demand areas |

| 2 | Purchase properties in prime locations |

| 3 | Set competitive rental rates |

| 4 | Maintain properties regularly |

| 5 | Screen tenants carefully |

-

Use Online Platforms: Websites like Craigslist, Zillow, or Apartments.com are great places to advertise your rental property for free.

-

Social Media: Use social media platforms such as Facebook, Instagram, or Twitter to showcase your property with attractive photos and detailed descriptions.

-

Signage: Put up “For Rent” signs outside your property to attract potential renters who pass by.

-

Networking: Let friends, family, and colleagues know that your property is available for rent. Word of mouth can be a powerful marketing tool.

By using these marketing strategies, you increase the chances of finding good tenants fast and avoiding periods of vacancy in your rental property.

Handling Problems Like a Pro

Handling rental property problems can be a tricky task, but with the right approach, you can manage them like a pro. Let’s take a look at some common issues you might face and how to tackle them effectively.

Dealing with Repairs

One of the most common problems in rental properties is when something breaks or needs fixing. Whether it’s a leaky faucet, a clogged drain, or a broken window, it’s essential to address repairs promptly to keep your tenants happy and maintain the value of your property. As a responsible landlord, you should have a list of reliable repair professionals that you can call on when needed. Make sure to communicate with your tenants about the repair timeline and always follow up to ensure the issue has been resolved to their satisfaction.

What if Rent Comes in Late?

Occasionally, you may encounter situations where your tenants are unable to pay their rent on time. It’s crucial to handle these situations with empathy and professionalism. Start by communicating openly with your tenants to understand the reasons behind the late payment. In some cases, creating a payment plan or offering a grace period can help alleviate the financial burden on your tenants while ensuring you receive the rent owed. Establish clear policies regarding late payments in your rental agreement to set expectations from the beginning.

Keeping Track of Money

When you own a rental property, it’s super important to know exactly where your money is going and coming from. This way, you can make sure your rental home is making as much money as possible. Let’s talk about why budgeting and keeping track of your finances is key to maximizing your rental property profitability.

Image courtesy of advice.onekeymls.com via Google Images

Budgets and Bookkeeping

First things first, you’ll want to create a budget for your rental property. This means writing down all the money you spend on things like maintenance, repairs, insurance, property taxes, and any other expenses related to your rental home. It’s also important to track the rent payments you receive from your tenants.

By keeping track of your expenses and income, you can see if you’re making a profit or if you need to make any adjustments to increase your rental property profitability. For example, if you notice that you’re spending a lot on repairs, you might look into making upgrades to the property to attract higher-paying tenants.

Bookkeeping is another important aspect of managing your rental property’s finances. This involves keeping detailed records of all your financial transactions related to the rental property. You can use spreadsheets or financial management software to track your income and expenses, making it easier to analyze your financial performance.

By maintaining organized budgets and accurate records of your rental property’s finances, you’ll be better equipped to make informed decisions that will help you maximize your rental income and overall profitability. Remember, keeping track of your money is a smart way to ensure your rental property continues to be a successful investment.

Smart Renting for the Future

As a smart rental property owner, it’s important to think ahead to make sure your investment continues to grow. By planning for the future, you can maximize your rental property ROI and keep your income steadily increasing over time. Here are some tips on how to future-proof your investment and make your rental property a long-term success.

Future-Proof Your Investment

One of the best ways to ensure your rental property remains profitable in the future is to stay updated on market trends and changes in the real estate industry. By keeping yourself informed, you can make strategic decisions when it comes to managing your property and setting the right rent price.

Additionally, consider making sustainable upgrades to your rental property. Energy-efficient appliances, solar panels, or smart home technology can not only attract more tenants but also save you money on utility bills in the long run. These upgrades can increase the overall value of your property, making it a more desirable rental option.

Furthermore, maintaining a good relationship with your tenants is key to the future success of your rental property. By being a responsive and attentive landlord, you can encourage long-term leases and reduce the turnover rate of your tenants. Happy tenants are more likely to take care of your property and pay rent on time, leading to a stable and profitable rental business.

Lastly, consider diversifying your rental portfolio by investing in different types of properties or in different locations. This can help spread out your risk and provide more stable income streams. By expanding your rental properties, you can mitigate the impact of economic downturns or market fluctuations on your rental income.

Conclusion: Reaping the Benefits

After learning all about managing a rental property, it’s time to summarize the best ways to make your rental property a successful and profitable venture.

Rental Property Profitability

By setting the right rent price, balancing costs and profits, you ensure that your rental property not only stays competitive but also brings in a steady stream of income. Additionally, keeping track of every penny through budgets and bookkeeping can help you make smart financial decisions that will ultimately increase your rental property’s profitability.

Optimizing Rental Management

One of the keys to a successful rental property is optimizing your management strategies. By finding good renters fast, communicating clearly and kindly with tenants, marketing your property effectively, and staying on top of repairs and maintenance, you can ensure that your rental property stays full and your tenants happy.

By following these best practices and tips, you can reap the benefits of owning and managing a rental property. Remember, a well-maintained and well-managed property will not only bring you financial rewards but also provide a sense of accomplishment and pride as a successful rental property owner.

FAQs

How often should I check on my property?

It’s a good idea to check on your rental property regularly to make sure everything is in good shape. Checking on your property once a month is a good starting point. This way, you can catch any small problems before they turn into big ones. It also lets you see if your renters are taking care of the place.

Can I raise the rent?

Yes, you can raise the rent, but there are rules you have to follow. Usually, you can’t raise the rent during your tenant’s lease period. When the lease ends, you can increase the rent if you think it’s fair. Just make sure to check your local laws to see if there are any restrictions on how much you can raise the rent and how often.

Idaho Poperty Management