Rebuilding Confidence Among Prospective Tenants: The Trust Deficit Healed?

The most profound, though harder to measure in dollars, implication is the potential for a **restoration of consumer confidence** in the rental housing search. The anxiety that comes with the rental process is often rooted in the feeling of being misled, a feeling that sinks in deep when financial stability is on the line.

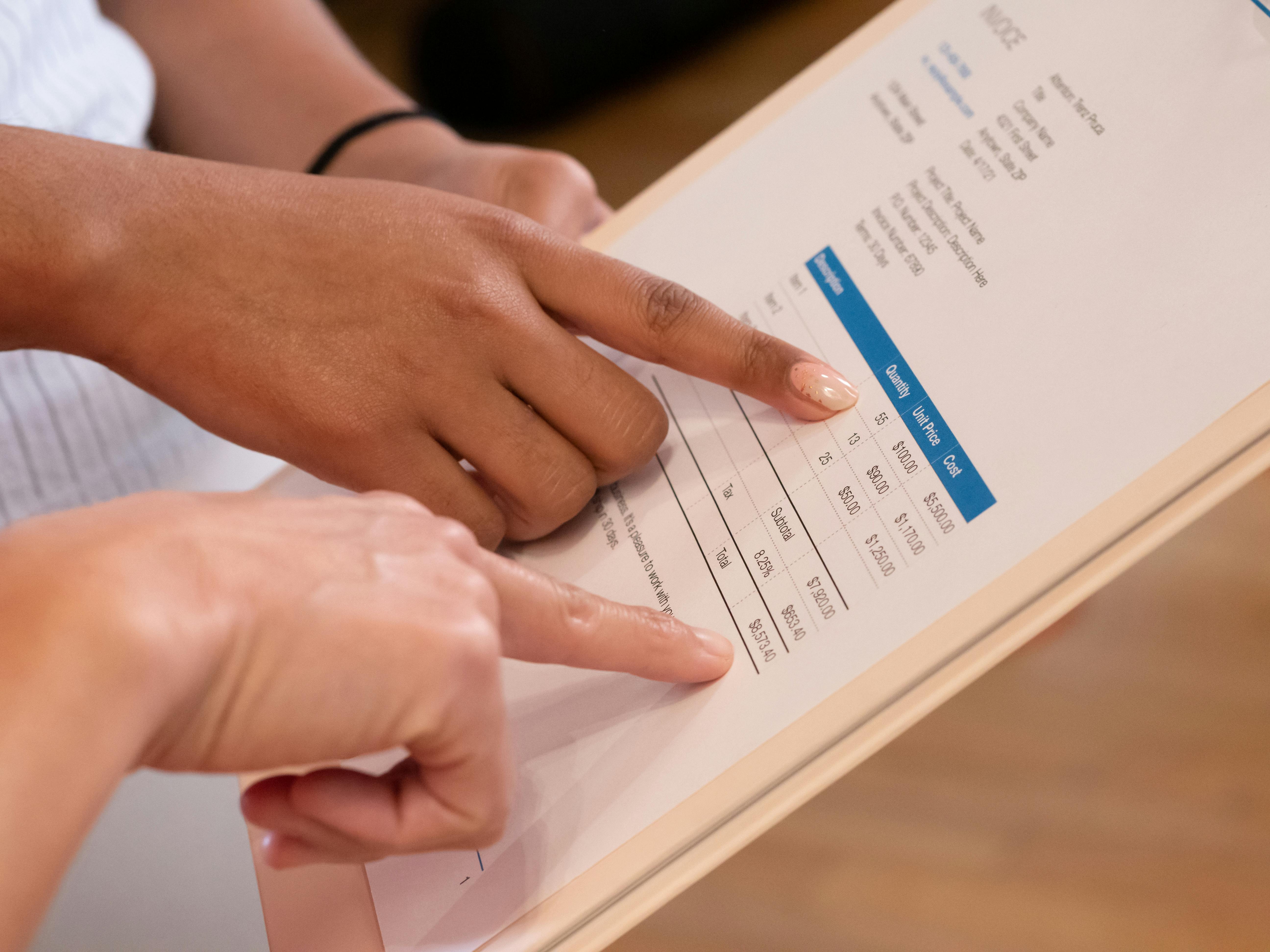

The Cost of the Hidden Hurdle

For the millions of Americans who rent—a demographic whose median age is now 42, a notable jump from just 36 in 2000—the surprise cost escalation erodes trust in the entire sector. That mandatory utility fee that wasn’t mentioned in the listing, the “community enhancement fee” that pays for services the apartment complex *should* provide anyway—these are the financial hurdles that make the housing search fraught. The FTC’s effort is a powerful validation of the consumer’s right to budget accurately. By demanding the true financial picture upfront, the agency is attempting to ensure that families can plan their monthly budget without encountering hidden, unexpected fees after they’ve already committed time and personal information during the application phase.

The Data on Renter Expectations. Find out more about FTC multifamily pricing transparency enforcement.

The regulatory push is not happening in a vacuum; it’s aligning with documented renter sentiment. A major 2025 survey indicated that an overwhelming **94% of renters expect full disclosure of all fees upfront** when viewing a listing. This signals that tenants are not just *accepting* hidden fees; they are actively *demanding* the transparency that the FTC is now codifying. When the industry successfully implements these new, straightforward measures, the housing search should transform from a game of financial detective work into a more predictable, honest transaction. This fosters a healthier, more trusting relationship between property operators and the vast demographic that relies on rental housing.

Navigating the New Regulatory Tide: Compliance and State Action

The FTC’s action is a high-profile federal intervention, but it is happening against a backdrop of burgeoning state-level activity. This patchwork of legislation is creating a compliance landscape that operators must manage carefully.

A National Trend Driven by State Law. Find out more about FTC multifamily pricing transparency enforcement guide.

The Greystar settlement and the FTC’s signal for new rulemaking are part of a larger, national conversation about fairness in leasing. In fact, states have already been moving aggressively: Colorado, Connecticut, Massachusetts, Virginia, and Washington all passed significant **fee transparency laws** in the 2025 legislative session, with some taking effect as early as January 2026. For property managers, this means complying with several overlapping standards. For example, some state laws dictate *when* the total price must be shown (e.g., before collecting personal information), which can be stricter than the FTC’s focus on advertising [cite: 5 from first search].

Actionable Takeaways for Property Operators:

If you manage rental property, standing still is not an option. You need a proactive compliance plan:

- Audit Every Fee: Scrutinize every charge outside the base rent. Is it genuinely optional? Is it tied to a specific, optional service? If it’s mandatory, it must be included in the advertised Total Monthly Leasing Price.. Find out more about FTC multifamily pricing transparency enforcement tips.

- Integrate Technology: Work with your property management software vendors to ensure that the total price—base rent plus all mandatory fees—is the most prominent figure on *every* listing, across *every* platform. This operational challenge is now central to marketing [cite: 1, 5 from first search].

- Consult Local Counsel: The FTC sets a floor, but state and local laws might impose higher standards or different timelines. Always consult with your **local counsel** regarding specific **fee transparency laws** [cite: 4 from first search, 3].

The Operational Balancing Act: Managing Costs in a Transparent World. Find out more about FTC multifamily pricing transparency enforcement strategies.

It is important to acknowledge the pressures landlords face. As referenced in numerous 2025 market reports, operational costs—property taxes, insurance premiums, and maintenance—have been rising sharply [cite: 5 from second search]. Landlords often see passing these costs on as a necessity to maintain profitability and reinvest in their properties.

The Cost-Push Versus Transparency Squeeze

This is where the *trade-off* becomes complex. Landlords are caught between genuine **rising operational costs** and the new mandate for upfront price clarity. If an operator is legitimately paying more for insurance and maintenance, they must find a way to recoup that cost without violating the new rules. * **The Risk:** If an operator absorbs all increased costs into the base rent to maintain a low “fee” structure, they might lose out on flexible pricing strategies that allow them to offer market-rate incentives or shorter lease terms. * **The Opportunity:** This forces operators to become leaner and more efficient. If you have to compete on the *true* price, you must aggressively manage your operational expenses rather than relying on masking them in disparate fees. This incentivizes smarter procurement and better vendor management, which benefits the property’s long-term health. This scenario echoes historical discussions around rent control, where policies aimed at capping *rents* sometimes unintentionally led to reduced maintenance or a shift in housing stock [cite: 14 from first search]. While fee transparency is not rent control, it *is* a form of price regulation that will have ripple effects on an operator’s P&L statement. The key difference here is the focus on *advertising* honesty, not *price setting* limits. For deeper analysis on how market forces shape rental rates, see our guide on **local market trends** [Internal Link Placeholder: URL for “local market trends” content].

Looking Ahead: A More Predictable Future for Renters. Find out more about FTC multifamily pricing transparency enforcement overview.

The long-term outlook hinges on industry adoption and sustained enforcement. If the trend initiated by the FTC and state legislatures continues, the rental search process for the average American will become dramatically less stressful and more fiscally predictable.

The Trust Dividend

When the price you see is the price you pay (plus utilities you choose), the foundational level of skepticism renters hold for the industry begins to erode. This “trust dividend” is invaluable:

- Higher Quality Leads: Properties that advertise truthfully will likely attract leads who are serious and financially qualified for the *actual* cost, leading to better tenant screening outcomes.. Find out more about Required all-inclusive monthly rental cost advertising definition guide.

- Reduced Friction: Fewer last-minute objections mean faster lease signings and a more efficient leasing team, which directly impacts occupancy rates and reduces costly vacancy periods. Studies show that transparency can **reduce lease friction** [cite: 11 from first search].

- Better Retention: Renters who feel treated fairly from the first advertisement to the final move-out are more likely to renew, which is critical when you consider the high cost of tenant turnover.

This evolving regulatory coverage marks a significant turning point. It’s a moment where legislative action aims to secure the **consumer financial stability** of millions by demanding market honesty. To understand how these changes might affect investment strategy, explore our insights on **rental housing investment**. [Internal Link Placeholder: URL for “rental housing investment” content].

Conclusion: The New Standard of Truth in Renting

The decree from the FTC—that the advertised rent must reflect the total, mandatory monthly cost—is more than just a compliance update; it’s a philosophical shift in the rental market’s operating ethos. The era of obscuring core monthly expenses with layers of mandatory fees is ending.

Key Takeaways and Final Thoughts

* Transparency is Now Table Stakes: With 94% of renters demanding upfront clarity, this is no longer a niche marketing advantage—it’s a regulatory and competitive necessity. * Competition Shifts to Value: Operators must now win on base rent, amenities, and service quality, as deceptive pricing tactics have been largely neutralized. * Trust is the New Metric: The long-term success for property operators will be tied to their ability to build and maintain renter trust through unwavering honesty in pricing. This is an opportunity for the rental housing sector to distinguish itself as an industry that respects the financial realities of its core demographic. The next few quarters will reveal which operators embrace this new standard of truth and which ones struggle to adapt their business models. What has *your* experience been with rental fee disclosures? Are you seeing properties already advertising the total price, or is the adjustment still underway? Share your thoughts below and let’s continue this essential conversation on the future of fair housing.